I have been watching the timeline lately. There is a specific kind of posting that always precedes a blow-up. It is not the arrogance, which is just leverage waiting to be corrected. It is the desperate posting.

We grow up with a simple heuristic: if you want something, you should try harder. Effort equals output. If you aren't getting what you want, you just need to "want it more." This works for digging ditches or lifting weights.

In trading, this heuristic is fatal.

If you look at the data on decision-making, you find a weird paradox. The more you "need" a trade to work (because of drawdown, bills, or ego) the less likely you are to execute it well. You aren't just unlucky. You are biologically blocking your ability to see the market clearly.

The Biology of "Sweating It"

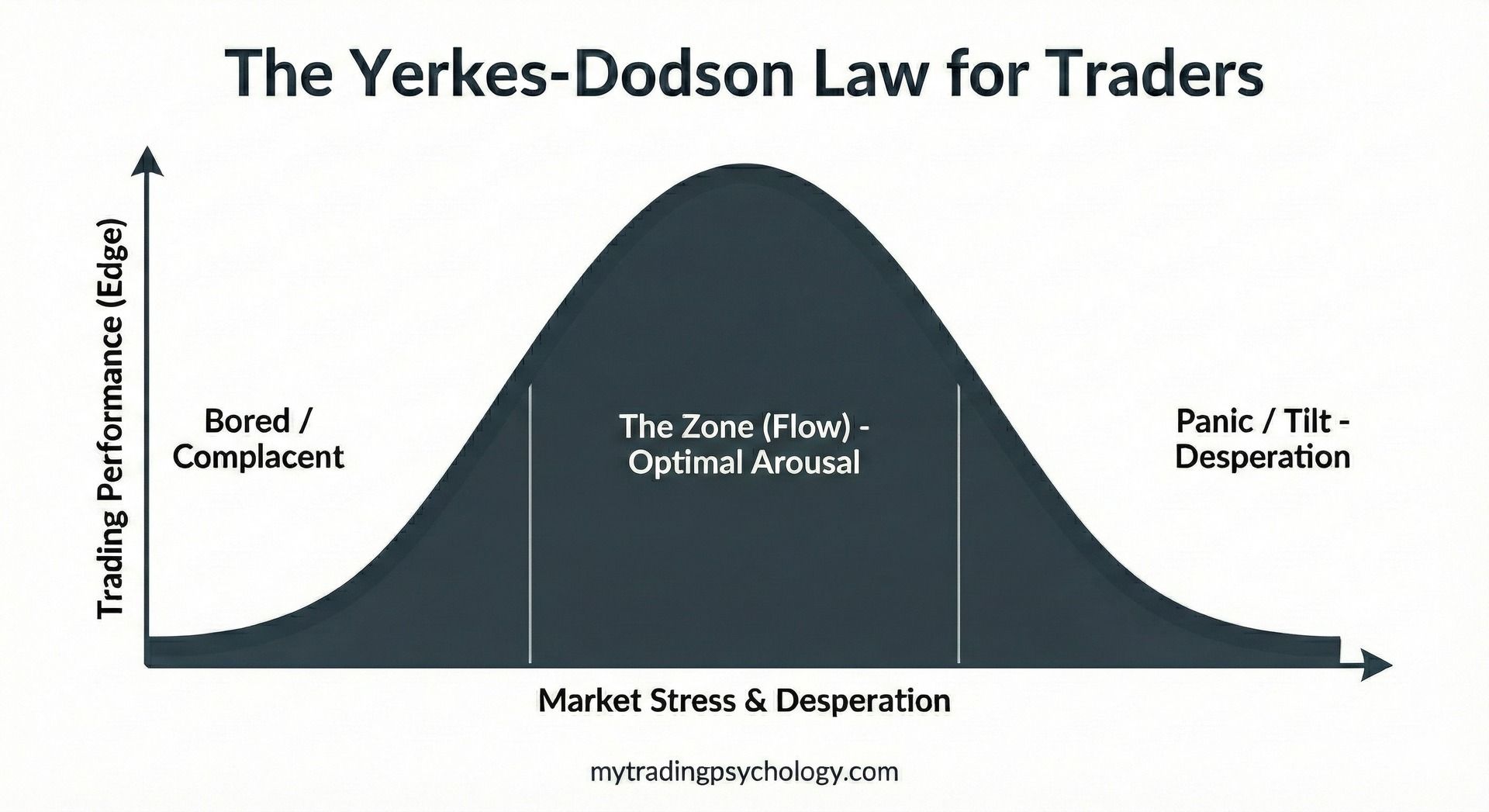

There is a concept in neuroscience called the Yerkes-Dodson law. It maps performance against arousal (stress/excitement).

When you move to that right side (I need to win!) your brain floods with cortisol. This does something very specific: it inhibits the prefrontal cortex. That is the part of your brain responsible for long-term planning, risk assessment, logic, and thus also good trading decisions.

At the same time, it activates the amygdala, the threat-detection center.

So, biologically, desperation switches your brain from a grandmaster chess player to a cornered animal. You literally lose access to the neural pathways that hold your edge. You stop seeing opportunities (upside) and start seeing only relief (exiting the pain).

This explains the "Manifestation Paradox" mentioned in the mental models many people share on X right now.

When you are desperate, you enter a scarcity mindset. Your brain narrows its focus to immediate survival. In trading, this manifests as:

Taking profits too early (fear of the green disappearing).

Holding losers too long (fear of realizing the loss).

Revenge trading (trying to force the market to fix your pain).

You are broadcasting a signal of "I am hunted." The market is an efficient machine for transferring capital from the hunted to the hunters.

The "No Big Deal" State

The highest performing state is what some call "calm confidence." Scientifically, this is just optimal arousal. You care enough to be attentive, but not enough to trigger the fight-or-flight response.

It is the state of zero resistance.

When you don't need the trade to work, your prefrontal cortex stays online. You can weigh probabilities. You can accept a loss as data rather than a personal indictment. You can let a winner run because you aren't terrified of it pulling back.

This is why paper traders often turn into killers, only to lose everything when they switch to live funds. The paper account carried zero resistance. The live account carried rent money.

How to Care Less

You cannot just "decide" to be relaxed. Your amygdala is faster than your conscious thought. You have to engineer it.

Size Down: If your heart rate spikes when you enter a position, you are too big. You have pushed yourself to the right side of the Yerkes-Dodson curve before the candle even closes.

Accept the outcome beforehand: Before you click buy, visualize the stop loss hitting. Genuinely accept this scenario. If you can't accept it, don't take the trade.

Detach from the timeline: Desperation usually comes from a self-imposed deadline ("I need to make $5k by Friday"). The market does not care about your schedule. Remove the clock, and you remove the pressure.

The less you need the market to give you something, the more capable you become of taking what it offers.